Accounting Examples

Scout Manager provides a robust accounting feature to allow units to easily manage finances. Documentation is rich and provides real-world examples units have already solved with Scout Manager financial management.

Accounting examples

Below are some common examples we've seen asked before. Remember that you only need accounts for things that you need to track so you should tailor your accounts to your specific needs. It is very helpful to have accounts for big ticket items like summer camp and monies you need to track over a period of time.

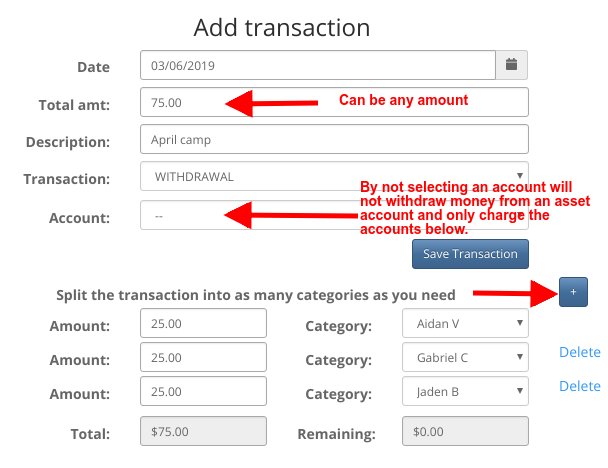

How do I charge a scout account?

To charge a scout's account:

- Set the amount and type a description

- Select WITHDRAWAL

- Select No Account

- For the category select the scout account you want to charge.

- Optional: press the + button to add another line item to add more scout accounts to charge

- Press Save Transaction

{:class="img-responsive"}

{:class="img-responsive"}

Donor has requested the $500 donation go toward scout scholarships.

Since this is income set up a revenue account (e.g. Donations). You'll also want to set up a liability account for the scholarships (e.g. Basic Scholarships).

- Create a deposit to accept the donation and set the total to $500

- Select the asset account where you'll be depositing the money (e.g. checking account)

- Add 2 split categories

- Set the first one for $500 into the income account (e.g. Donations)

- Set the second one for $500 into the liability account (e.g. Basic Scholarships)

- Scout Manager will provide a warning you can safely ignore. Press Save Transaction

When it's time to award a scholarship

- Create a transfer transaction and set the amount (e.g. $50.00)

- Check the box to Transfer between users/liabilities

- Set the first account to the liability to transfer from (e.g. Basic Scholarships)

- Set the second account to the user/scout to transfer (e.g. Johnny Scout)

- Press Save Transaction

You've just awarded the scout a $50 scholarship.

How to create the transactions for Day Camp?

Set up a Liability account for Day Camp and Member accounts for all scouts (and adults). Johnny Scout gives you $50 for camp. It's a 2-step process to properly record the transaction so everyone knows the money came from and where it's planned to be spent.

- create a DEPOSIT for $50 into Pack Checking account and credit Johnny Scout's account.

- create a TRANSFER for $50 from Johnny Scout's account into Day Camp.

If a scout decides not to attend Day Camp...

- create a TRANSFER for $50 from Day Camp into Johnny Scout's account.

When it's time to pay Day Camp..

- create a PAYMENT for $50 from Pack Checking account and debit Day Camp.

Your goal is to have $0.00 left in Day Camp. It's ok if you don't, but you'll want to know how to handle any overages. It may stay and rollover into next year or transfer it to another account to be used in another way.

How do you record Donations?

Donations can be tricky if the donor requests you use the money a certain way. Let's say you get $1000 and the donor wants you to spend 50% on Day Camp scholarships and 50% on new tents.

- Create a DEPOSIT for $1000 into Pack Checking account and credit $500 to Day Camp Scholarships and $500 to New Tents revenue accounts.

When you have a scout who needs a Day Camp Scholarship..

- create a TRANSFER for $50 from Day Camp Scholarship into Johnny Scout's account

- create a TRANSFER for $50 from Johnny Scout's account into Day Camp liability account.

Why do you need 2 transactions? This will help you identify who received the scholarship money and how it was spent.

When you buy new tents...

- create a PAYMENT from Pack Checking account and debit New Tents account.

Tracking money for camp outs

A scout puts $100 on his scout account to pay for camping trips. There are a couple of different ways to handle this in Scout Manager, but I'm going to just show you the accounting portion.

- Create a DEPOSIT for $100 into Pack Checking account and credit $100 to Johnny Scout's account.

When you need to charge for a camp out.

- Create a TRANSFER for $20 from Johnny Scout's account into April Campout liability account.

When you need to reimburse an adult for buying food for the camp out.

- Create a PAYMENT from Pack Checking account and debit April Campout liability account

This may look like a lot to take in at first -- you'll need to read through a few times before setting your accounts in Scout Manager. Set an initial balance for your Pack Checking account (like $1000) so you can run through these steps as a mock up and actually create all those transactions. When you're ready to start over and set it all up for real, you can delete everything very quickly with the link below.

Collecting money for Summer Camp

Set up a liability for Summer Camp to collect the money into, you should also have User accounts for each scout/adult. Now create a transfer for the correct amount and description. Select the checkbox to transfer between users/liabilities. Now you can select the scout and then the Summer Camp liabilty account. This will change the scout the amount for summer camp (a negative entry) and move it into Summer Camp (a positive entry). When it's time to pay the balance, create a withdrawal against checking account and summer camp. Example actions below

Action: Assumptions

- All dates and amounts are hypothetical

- Summer camp is $300 per scout this year.

- You require an additional $15 per scout for transportation costs. Total cost per scout is $315

- You need a $100 deposit per scout by February 15 to ascertain interest and to hold their spot.

- You have to paid a $500 deposit to the camp by March 15.

- You want to collect money for summer camp over a period of time so scout's can pay a little over a few months instead of the entire lump sum all at once.

- You already have a checking account established

Action: Set up the accounts

- Account Management => Liabilities

- Create a liability account for summer camp. Give it a $0 balance. It will be used to hold money scouts are paying for summer camp. 100% of the money in this account will go to the summer camp or be used for transportation reimbursements.

- Account Management => Users

- Create each scout a user account. This simply a liability account but is directed towards scouts and adults so they are easier to find.

- Account Management => Expenses

- Create an expense account for summer camp so you can track all expenses. We'll use it to track any expenses and will help you know expenses over time so you can be better at planning next year.

Action: Charge scout accounts for summer camp deposit

- You have 5 scouts who have committed to summer camp. It's February 15 so you are ready to charge their accounts. Charge next account with this action below.

- Dashboard => Add transaction

- Total Amount: $100

- Description: Summer camp deposit

- Transaction type: TRANSFER

- Check the box Transfer between users/liabilities

- Account: [select the scout to charge]

- To Account: [select the Summer Camp liability account]

- Save Transaction

- You now have $500 in Summer Camp liability account and each scout has a $100 transfer charge on their account

Action: Receive money

- The parents see the charge and send $100 for each scout. You nee to record receiving the money for each scout.

- Dashboard => Add transaction

- Total Amount: $100

- Description: Summer camp payment

- Transaction type: DEPOSIT

- Account: [select the checking account]

- Category: [select the scout account to deposit into]

- Amount: $100

- Save Transaction

- You now have an additional $500 in the checking account so you can pay the summer camp deposit.

Action: pay the summer camp deposit

- You write the check and send it off to the summer camp. Record it as follows.

- Dashboard => Add transaction

- Total Amount: $500

- Description: Summer camp deposit payment

- Transaction type: WITHDRAWAL

- Account: [select the checking account]

- Category: Summer Camp

- Amount: $500

- Save Transaction

- By selecting both the checking account and summer camp on a withdrawal, you have reduced both accounts by $500.

Action: charge scouts final amount for summer camp

- It's time to charge the remaining amount for summer camp. Scouts who have paid the deposit of $100 should be charged $215 ($315 - $100 = $200)

- Dashboard => Add transaction

- Total Amount: $215

- Description: Summer camp final charge

- Transaction type: TRANSFER

- Check the box Transfer between users/liabilities

- Account:[select the scout to charge]

- To Account: [select the Summer Camp liability account]

- Save Transaction

- You now have $1075 in Summer Camp liability account and each scout has a $215 transfer charge on their account

Receive money the same as described above. Parents/scouts could pay as lump sum or over time to bring their balance up from negative. Once you've collected enough money to make the final payment to summer camp you would handle it just like you paid the deposit above.

Action: Reimburse parent or leader for transportation expenses

- It's very common to have a parent or leader drive for you. Sometimes they may need to get reimbursed due to length of travel, pulling a trailer, etc.

- If you write them a reimbursement check, use the same instructions above for payment to summer camp.

- If they want you to reimburse by crediting their scout account, follow these instructions

- Dashboard => Add transaction

- Total Amount: $50

- Description: Summer camp fuel reimbursement

- Transaction type: TRANSFER

- Check the box Transfer between users/liabilities

- Account: [select the Summer Camp liability account]

- To Account: [select the scout account to credit]

- Save Transaction

Parent Reimbursement

I have reimbursed parents for expenses related to campouts, and was able to charge the Campout liability account.

Now I have a parent who made a purchase from the Scout shop for troop items, and used her own funds because the Scout shop balance was depleted. Since the amount was small, she did not ask for a cash reimbursement but just to have it put into her scout's account.

In QuickBooks, I just transferred funds from the General Fund to her scout's fund, and in so doing was able to both adjust the account balances for both sides as well as "charge" the purchase against the "Awards" expense account. But I cannot figure out how to perform this reimbursement, since we don't have a "General Fund" liability account.

So, two questions:

- Should I have a General Fund? Or is the General Fund simply the assets minus all liability accounts?

- How do I record this transaction/expense, and still transfer the funds into the Scout's account?

Use the Adjusting Entry (from Transfer) to DEBIT the Awards account and CREDIT the scout's account. This increases both accounts so you'll be able to keep track of your Expenses while crediting the scout's account.

Popcorn Fundraiser

Popcorn fundraisers are popular in the BSA as a great source of income for the unit. Some units share the profits with scouts into their own accounts, while others simply keep the money in a general account available for use by the unit. As you collect sales money, deposit the money into the Popcorn Asset account and credit the Popcorn Revenue. When it's time to pay for the popcorn, pay from the Popcorn Assets and debit the Popcorn Expenses.

The account setup looks like this:

| Type | Name |

|---|---|

| Asset | 2013 Popcorn Assets |

| Expense | 2013 Popcorn Expenses |

| Revenue | 2013 Popcorn Revenue |

If you decide to share profits with your scouts, you can debit the Popcorn Revenue and credit the Member accounts. Money left in the Popcorn Asset account can be transferred into the unit's general asset account.

Fall Camporee Example

Let's say you are attending a Fall Camporee and the total cost is $40 per scout. $25 is for food and $15 is for the Fall Camporee registration. We have 2 Liability accounts to split the money. We've used liability accounts (not Revenue) because this is not a fundraiser for the unit. All the money collected should go towards the camporee.

The account setup looks like this:

| Type | Name |

|---|---|

| Asset | Fall Camporee Assets |

| Expense | Fall Camporee Expenses |

| Liability | Fall Camporee Food Payable |

| Liability | Fall Camporee Registration Payable |

As you collect money from the scouts, split the food and registration money into the 2 different accounts. Deposit all money into the Fall Camporee Assets account and credit $25 into Fall Camporee Food and $15 into Fall Camporee Registration accounts. When the time comes to pay for the Camporee Registration, make the payment from the Fall Camporee Assets and debit the Fall Camporee Registration account. When the time comes to reimburse the Food Dudes for buying the food, reimburse them from the Fall Camporee Food account.

If either account comes up short, you'll know someone either didn't pay or you didn't collect enough.

T-shirt Example

You unit wants to buy BSA logo t-shirts and sell them back to the scouts as they need them. T-shirts cost you $9 and you charge scouts $10. You want to be able to track over time how much investment you have in t-shirts.

The account setup looks like this:

| Type | Name |

|---|---|

| Asset | T-shirt Inventory |

| Expense | T-shirt Expenses |

| Revenue | T-shirt Revenue |

You buy 100 shirts costing you $900. You want to track when a scout gives you money to buy a shirt and you already have scout member accounts set up.

- purchase t-shirts debit T-shirt Inventory account (increase inventory) and credit Cash account (decrease cash)

- scout buys a t-shirt

- $9 debit to T-shirt Expense (increase in expenses) and $10 credit to T-shirt Revenue (increase in revenue)

- $10 debit to Cash (increases cash) and $10 credit to T-shirt Inventory (reduces inventory)

Associate a user profile with an account

You can set up MEMBER accounts for every person in the troop and then associate it with their user profile. When you set up the accounting system for the first time, it will handle this for you automatically. But sometimes you may want to add someone to an Asset, Expense or other account type.

To associate a user profile with any account, view the account details and press the Add User button. Type the user's name, select it and press Add Selected. Now the user can see the balance and transactions from the Accounts tab on their user profile. Keep in mind, parents of scouts will automatically see their son's account so there's no reason to add them manually.